Program’s General Objective

Streamline business activity in areas that have been affected by natural disasters in order to contribute to the generation of employment sources and the rehabilitation of economic activity in those areas.

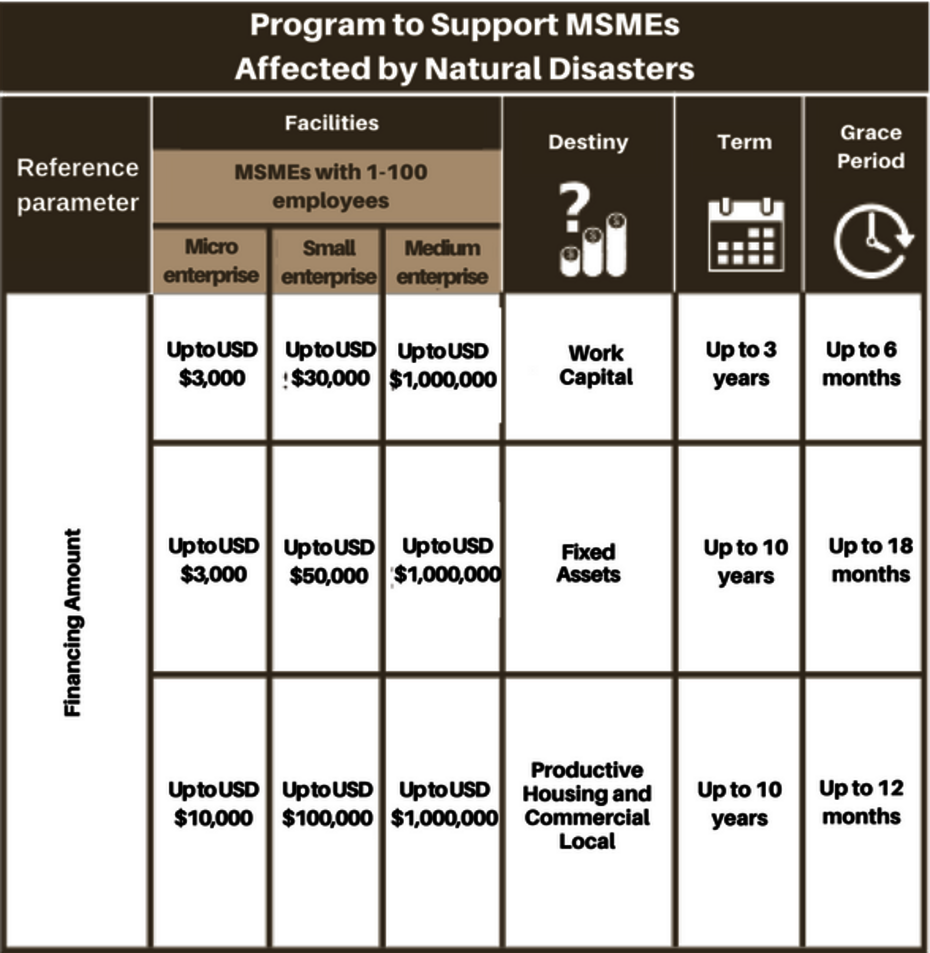

* Currently, only the MSME sector in Guatemala is benefited by this program, since historically it is the country with the highest number of losses caused by natural disasters in Central America.

Program to Support MSMEs Affected by Natural527 KB

Streamline business activity in areas that have been affected by natural disasters in order to contribute to the generation of employment sources and the rehabilitation of economic activity in those areas.

| - Be part of Central America’s largest and most renowned intermediary base, which channels resources to different areas of development. | - Pursuant to your growth and performance, request future extensions to your GCL amount. |

| - Use the resources of the approved GCL, in dollars or local currency, pursuant to your financing needs. | - Preferentially opt to technical assistance resources for expansion and strengthening. |

| - Choose different CABEI programs and products, which have been established with the Bank’s own resources and resources from international cooperation organizations. | - Benefit from the different products and services developed by CABEI to strengthen the financial sector, which attends different areas of the region. |