Short-term Funding Instruments

The Central American Bank for Economic Integration (CABEI) provides a range of short-term financing programs designed to help central banks manage their international reserves and other financial institutions to manage their investment portfolios.

The current programs are the Certificates of Deposit Program and the Commercial Paper Program.

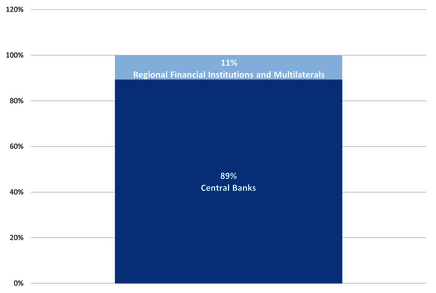

The Certificates of Deposit Program is the main source of short-term funding for CABEI and dates back to 1978. CABEI's consolidation as one of the best credit risks in Latin America positions it as an important recipient of international reserves from Central Banks in the region. These types of investors are the main drivers of CABEI deposits under the Program, which is also complemented by investments from Public and Private Financial Institutions, Multilaterals and Commercial Banks, among others.

The main characteristics of the Certificate of Deposit Program are the following:

- Minimum investment amount: US$1 million.

- Tenor: from 1 day to 365 days.

- Currency: United States dollars.

- Format: Hard Copy or via Swift Message.

Global

The Global Commercial Paper Program (USCP Program) is a short-term funding instrument (with a maximum tenor of 270 days) whose origin dates back to 1999 and it’s settled through "The Depository Trust Company (DTC)".

Regional

The Regional Commercial Paper program dates back to 2009 and is a short-term funding instrument registered in Costa Rica for placements of less than 1 year, both in Costa Rican colons and in United States dollars.