Benefits for the Final Beneficiary

Access to financing with payment methods adjusted to the cycles of the projects attended, so that the producers can face their debts according to their availability of cash, meaning that they can cancel their loans based on the productivity of their crops. In addition, they will have liquidity to boost their production cycle, develop investment projects to expand their operations in the national and international markets and generate productive and value chains, among other benefits.

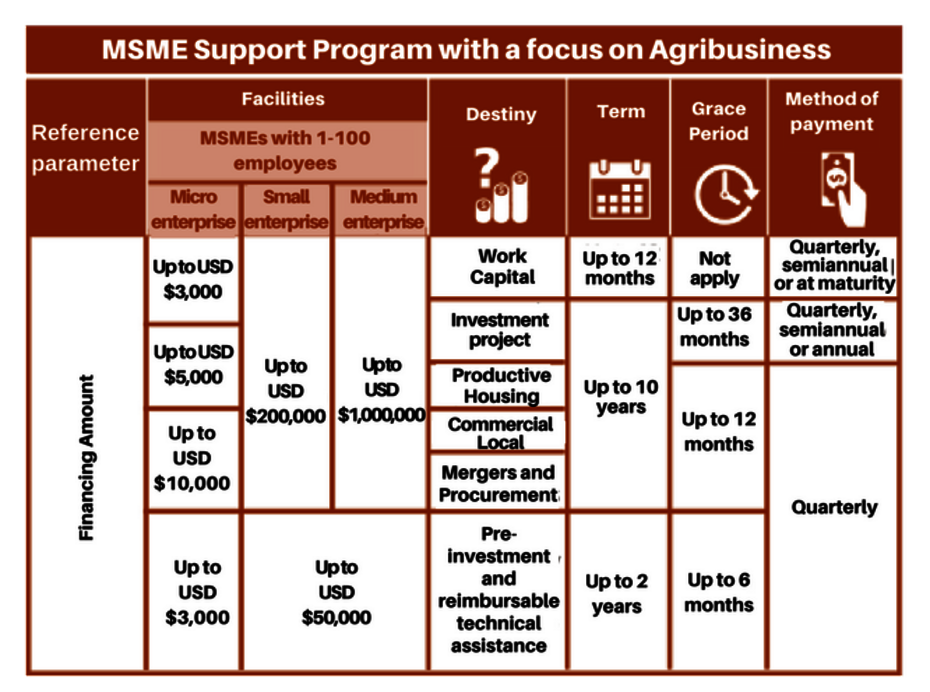

MSME Support Program with a focus on Agribusiness1 MB

Support the development of MSMEs in the agricultural sector through access to credits that will enable them to invest in new technologies in order to strengthen their competitiveness.

| - Be part of Central America’s largest and most renowned intermediary base, which channels resources to different areas of development. | - Pursuant to your growth and performance, request future extensions to your GCL amount. |

| - Use the resources of the approved GCL, in dollars or local currency, pursuant to your financing needs. | - Preferentially opt to technical assistance resources for expansion and strengthening. |

| - Choose different CABEI programs and products, which have been established with the Bank’s own resources and resources from international cooperation organizations. | - Benefit from the different products and services developed by CABEI to strengthen the financial sector, which attends different areas of the region. |