Program’s General Objective

Strengthen the financial system that attends micro, small and medium-sized enterprises (MSMEs) by facilitating access to credits through IFIS in order to provide MSME owners with the opportunity to streamline their activities and increase their development, which will also contribute to employment and wealth generation within the framework of sustainable development.

Benefits for Financial Institutions

The financial institution will have the opportunity to attend a large number of clients; it is estimated that at least 95% of the companies in the region belong to the MSME sector. In addition the IFI will have the opportunity to access favorable financing conditions which in turn will allow it to offer more competitive rates and terms, pursuant to the needs of MSMEs.

Final Beneficiary of the Resources

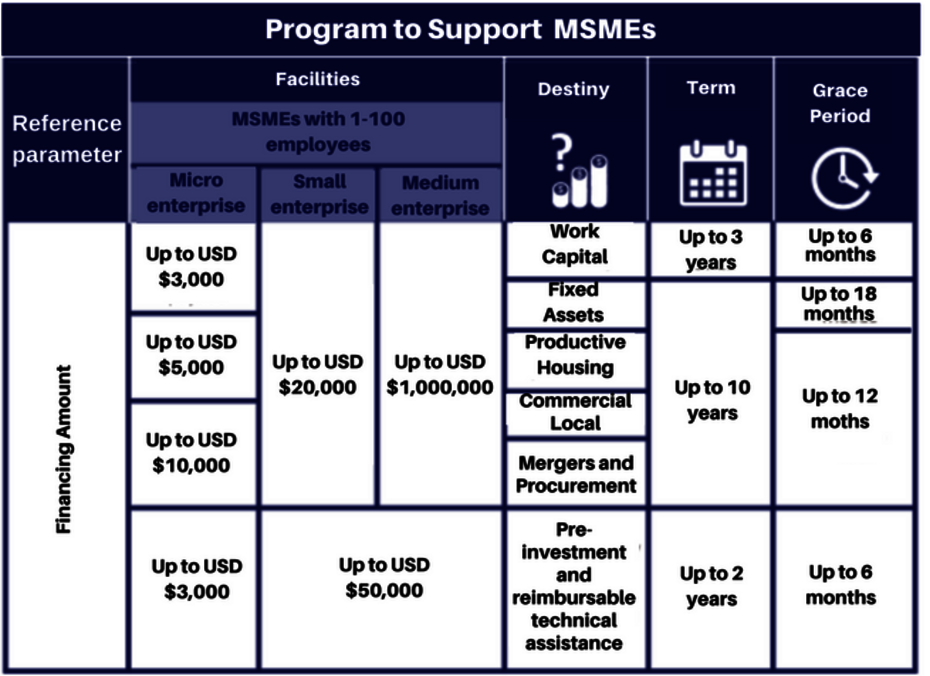

People who own micro, small and medium enterprises (MSMEs) with a maximum of 100 employees, and individuals with entrepreneurship who wish to develop or improve their businesses by efficiently managing energy resources in order to achieve or improve productivity and competitiveness levels.

Resource Source

This program has financial support from the Republic of China (Taiwan) International Cooperation and Development Fund (ICDF), the Spanish Agency for International Cooperation and Development (AECID), the OPEC Fund for International Development (OFID) and the German KfW Development Bank, in addition to CABEI’s participation as executing unit.

Descargar brochure

MSME Support Program310 KB

Strengthen the financial system that attends micro, small and medium-sized enterprises (MSMEs) by facilitating access to credits through IFIS in order to provide MSME owners with the opportunity to streamline their activities and increase their development, which will also contribute to employment and wealth generation within the framework of sustainable development.

| - Be part of Central America’s largest and most renowned intermediary base, which channels resources to different areas of development. | - Pursuant to your growth and performance, request future extensions to your GCL amount. |

| - Use the resources of the approved GCL, in dollars or local currency, pursuant to your financing needs. | - Preferentially opt to technical assistance resources for expansion and strengthening. |

| - Choose different CABEI programs and products, which have been established with the Bank’s own resources and resources from international cooperation organizations. | - Benefit from the different products and services developed by CABEI to strengthen the financial sector, which attends different areas of the region. |