Central American Bank for Economic Integration and Costa Rica's National Stock Exchange sign agreement to support the structuring of thematic issuances

The agreement consists of providing non-reimbursable technical advice to issuers to create the required frameworks.

San José, October 20, 2021.- The Central American Bank for Economic Integration (CABEI) and the National Stock Exchange (BNV) signed an agreement for issuers to be advised and have reference frameworks for thematic issues in compliance with international standards applicable to these instruments in relation to the use of funds, the selection of projects to be financed, the administration of the resources raised, and accountability.

This type of issuance is a new stock market instrument aimed at financing or refinancing projects linked to one of the 17 sustainable development goals, allowing Costa Rica to make progress in achieving them.

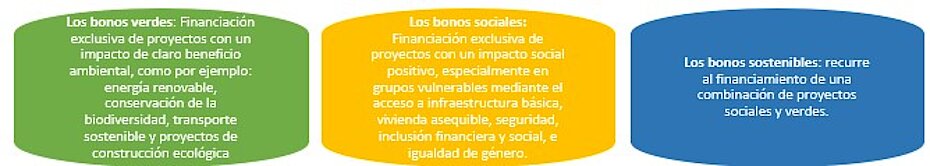

Among the best known thematic issues are green, social, and sustainable bonds:

"We are pleased to join forces with the BNV of Costa Rica and materialize such important support as advisory services for issuers to venture into new stock market instruments. This is the beginning of a program that will become a benchmark in the Central American region in order to promote the placement of thematic issues in the markets and contribute to sustainable development," explained CABEI Executive President, Dr. Dante Mossi.

The resources for this agreement were made possible thanks to a contribution from the French Development Agency (AFD). Juliette Grundman, AFD Regional Director for Mexico, Cuba and Central America, commented: "On the one hand, we at AFD have been collaborating with CABEI since 2016 to promote the financing of climate and gender equality projects in the Central American region; on the other, we have been supporting the Costa Rican government since 2019 in the implementation of its decarbonized and inclusive trajectory. So, it seemed obvious to us to accompany, through our cooperation with CABEI, this innovative initiative to develop thematic emissions in Costa Rica, which will enrich the range of tools available to ensure sustainable development in the region."

According to Roberto Venegas, president of the Board of Directors of the Bolsa Nacional de Valores, "the Bolsa has been enabling conditions that facilitate issuers to finance projects with environmental and social benefits through thematic issues. In this case, thanks to CABEI's support, issuers will be given the opportunity to receive free advice and training to create part of the pre- and post-issuance documentation."

In addition to creating frameworks for thematic issues, the agreement also provides for the training of issuers so that, in the future, they can develop their own frameworks. It will also help them to develop criteria for the appropriate selection of projects to be financed and to define the structure of the annual reports to be submitted to investors, in which they will report on the use of funds and the impact of the projects.

Moreover, it will provide issuers with the necessary material to guide them on how to incorporate Environmental, Social and Governance (ESG) criteria into their business strategy and learn about the advantages that this represents.

The agreement between CABEI and BNV will be valid for 2 years, with the possibility of extension upon mutual agreement.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/0/b/csm_Emi1bcieArtboard_1_b696f04dae.png)