Mexico has been a non-regional CABEI member since 1992 with an authorized stake of USD306.25 million in the Bank's share capital and capital contributions of USD76.56 million, ranking as the third largest shareholder within the group of non-regional members with 5.03%.

The contribution that Mexico channels to the Central American region through CABEI is based on various financial cooperation instruments with Banco Nacional de Comercio Exterior S.N.C. (Bancomext) for a total amount of USD520.8 million. The relationship between the Bank and this country was solidified in 2008 with the launching of the Central American Social Housing Development Program. It falls under the framework of the Mesoamerican Integration and Development Project (formerly Plan Puebla Panamá). Since that date, the Mexican government has made resources available to develop a sustainable market for long-term housing finance in the Central American region that addresses the housing deficit and future needs in this area. Throughout the Program's existence, 59 disbursements have been made through 14 intermediary institutions. In total, 192.7% of the initial financing available has been channeled, benefiting a total of 8,032 low- income households, which can now enjoy a more dignified home.

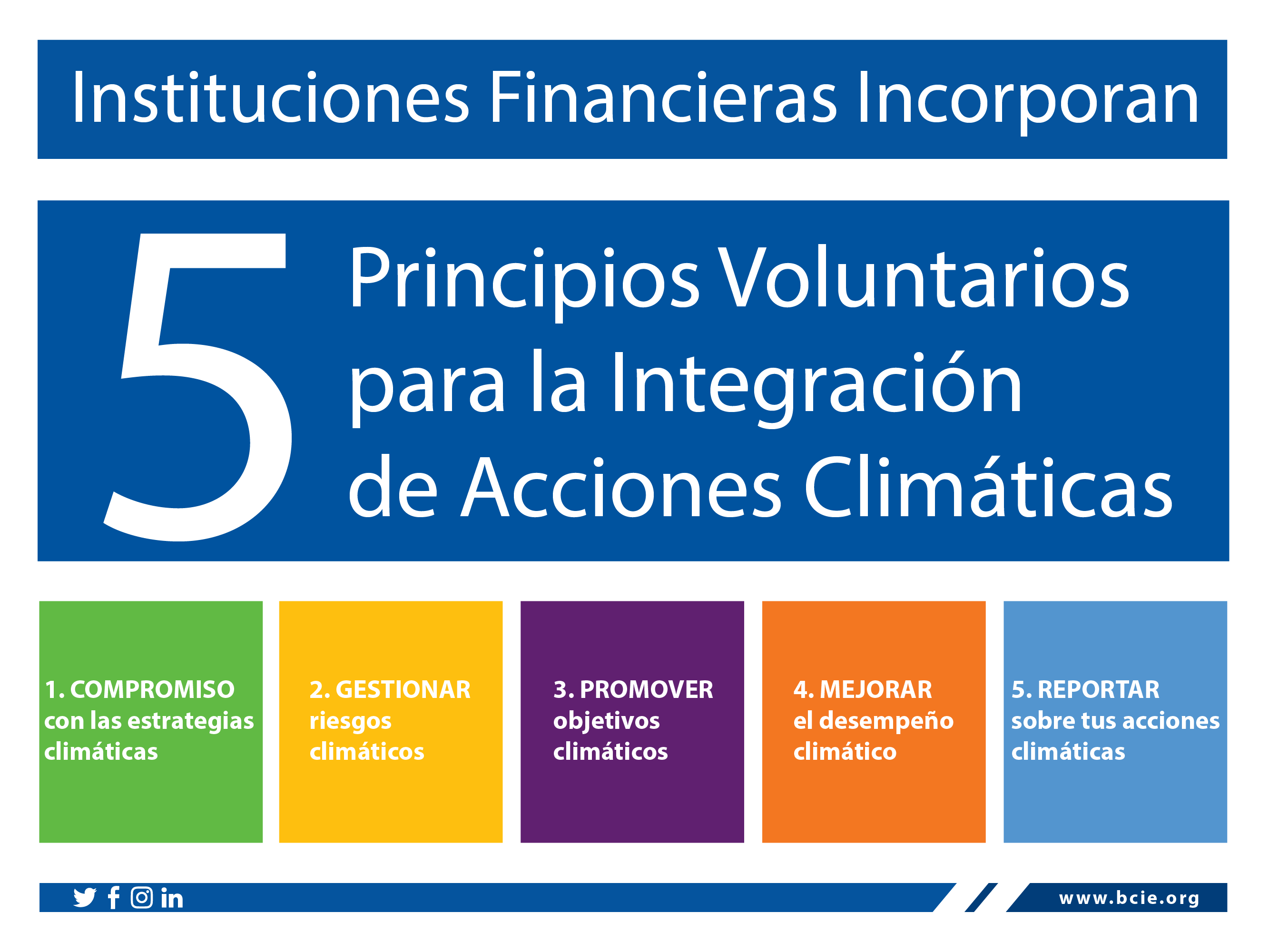

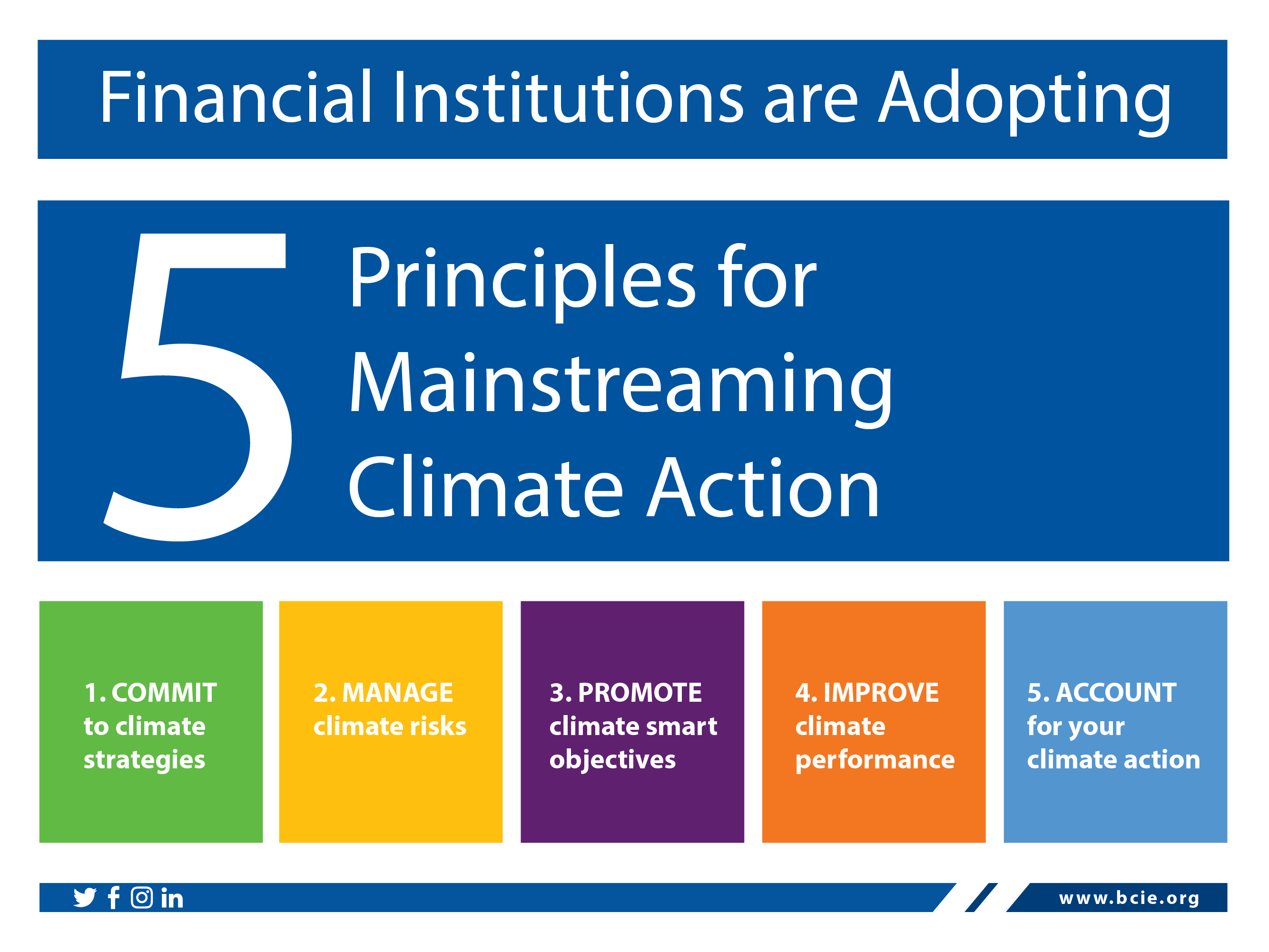

CABEI expresses its support for the Five Voluntary Principles for the Integration of Climate Actions

With this announcement, CABEI joins a coalition of 30 leading financial institutions that support the initiative.

Tegucigalpa, December 11, 2017. - Today, during a High Level Public Event on the Integration of Climate Action in financial institutions (www.mainstreamingclimate.org) held in France, the Central American Bank for Economic Integration (CABEI) expressed its support for the Five Voluntary Principles for the Integration of Climate Actions within Financial Institutions. With this announcement, the Bank joins 30 other financial institutions that support the initiative.

In December 2015, a coalition of 26 leading global financial institutions signed the five voluntary principles denominated "Principles for the integration of climate action within financial institutions," committing themselves to expand their efforts to address climate change and integrate climatic considerations into their investments. To date, the initiative has the support of 30 financial institutions.

The principles describe how financial institutions can: Commit to climate strategies; manage climate risks; promote climate-smart goals; improve climate performance; and ensure transparent accountability regarding climate change investment.

The principles were initially developed by a group of multilateral development banks and several members of the International Development Finance Club (IDFC), which is a network of national, regional and international development banks of which CABEI is a founding member.

CABEI will continue to promote and support actions to finance climate change adaptation and mitigation, as well as to incorporate climate change in all its operations. This commitment is in line with its 2015-2019 Institutional Strategy and linked to the financing needs of its member countries due to their high vulnerability to climate change events.

CABEI Executive President, Dr. Nick Rischbieth stated that, "In response to this commitment during the 2015-2016 period, CABEI approved operations to finance projects that include climate change adaptation and mitigation actions in the amount of US$1.24 billion, of which 772 million was approved in 2016 representing an increase of 66% compared to approvals in 2015.”

These figures demonstrate the Bank's commitment to contribute to its member countries in their efforts to face the effects of climate change through the achievement of the commitments assumed under the framework of the Paris Agreement; its support in the preparation and implementation of the Intended Nationally Determined Contributions (INDC) subscribed by the countries; and its provision of the necessary actions for the transition to long-term development pathways resistant to climate change with low carbon emissions.

In order to benefit its member countries, CABEI incorporates climate change considerations into its strategies, activities and procedures. In addition, its actions are aligned with the five Voluntary Principles for the integration of climate action in financial institutions, with special attention to climate risk management and the integration of climate resilience and adaptation.

President Rischbieth highlighted that "By adapting these principles to our actions, we confirm the Bank's commitment to promote and support actions to finance climate change adaptation and mitigation, as well as to incorporate climate change in all of its operations.”