Benefits for Final Beneficiary

The program offers the following benefits:

- Financing to execute export transactions of primary, semi-manufactured and manufactured products, as well as traditional and non-traditional products and capital goods, originating from CABEI’s founding or beneficiary countries.

- Financing for operations to cover pre-shipment, post-shipment and post-import periods in order to facilitate the exports of products and the incorporation of goods and services that contribute to the region’s development.

- Financing for import transactions involving raw materials, inputs, intermediary goods and capital goods, which contribute to industrial reactivation and generate competitiveness at the regional production level.

Resource Source

The program is funded by resources from the Central American Bank for Economic Integration (CABEI) and support from the Institute of Official Credit (ICO), which provides financing to Spanish companies with a presence in Central American countries or companies in the region that purchase goods or services from Spanish companies.

Foreign Trade Program COMEX983 KB

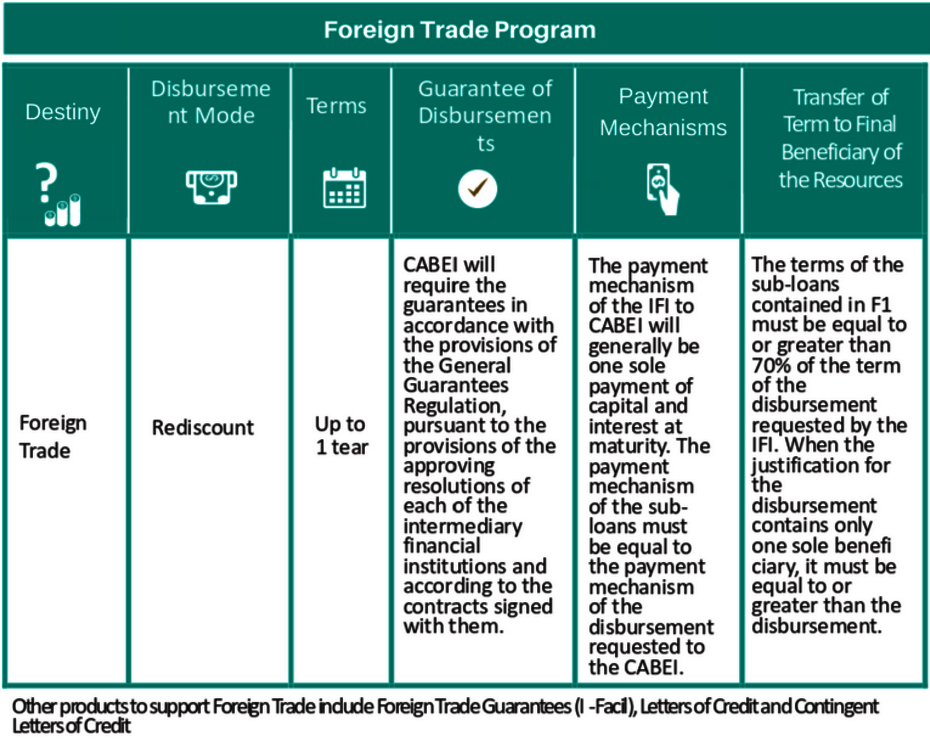

Channel resources to Intermediary Financial Institutions (IFIs) in order to support activities involving the import and export of goods and services.

| - Be part of Central America’s largest and most renowned intermediary base, which channels resources to different areas of development. | - Pursuant to your growth and performance, request future extensions to your GCL amount. |

| - Use the resources of the approved GCL, in dollars or local currency, pursuant to your financing needs. | - Preferentially opt to technical assistance resources for expansion and strengthening. |

| - Choose different CABEI programs and products, which have been established with the Bank’s own resources and resources from international cooperation organizations. | - Benefit from the different products and services developed by CABEI to strengthen the financial sector, which attends different areas of the region. |