The issuance of bonds through the capital markets is CABEI's leading source of financing, in line with its preference for stable funding sources and the rating increases obtained over the last years, which have consolidated it in the global markets as a sovereign, supranational and agency (SSA) issuer.

In addition, CABEI receives resources through bilateral financing with agencies that seek to channel concessional resources to the region for the development of the countries and to strengthen their adaptation to climate change, among other aspects.

The issuance of bonds has made it possible to find efficient financing alternatives by presenting the flexibility required to meet the particular needs of each type of investor.

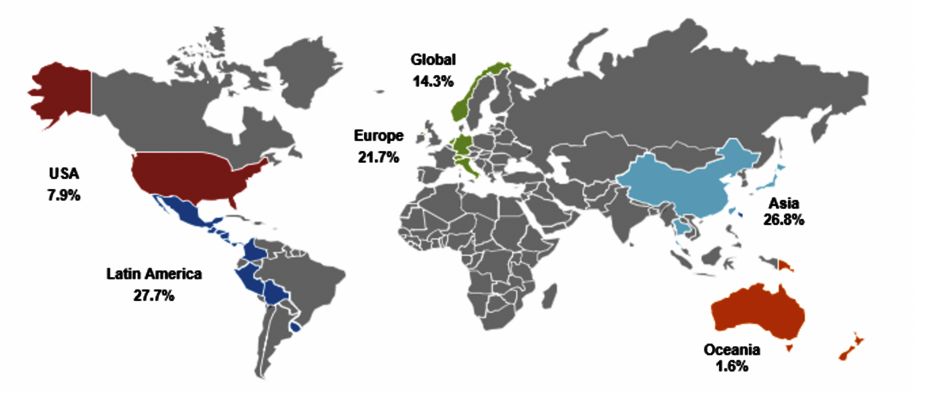

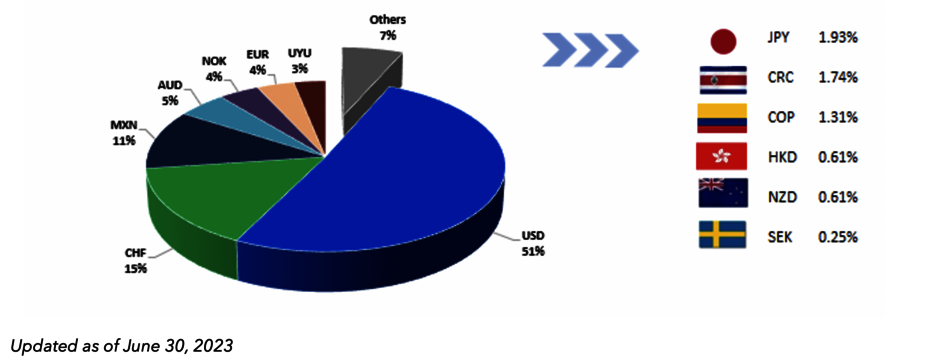

Since its first incursion into the capital markets in May 1997, CABEI has placed 166 issues in 25 currencies and 23 different markets, reaching an aggregate amount of funds raised for the equivalent of US$17,424.5 million for the region's development.

Furthermore, CABEI is a pioneer and innovative issuer in Environmental, Social, and Governance (ESG) emissions. The Green Bond Framework development was in 2019 and subsequently updated in 2022 to incorporate blue taxonomy. In addition, in 2020, CABEI created a Social Bond Framework, consolidating its position as a relevant contributor to the achievement of the United Nations Sustainable Development Goals (SDGs) (2015-2030).

Both instruments have a favorable opinion from Sustainalytics, a leading independent firm in developing and evaluating sustainable frameworks. Since then, CABEI has promoted issuing green, blue, and social bonds under these frameworks, integrating best practices for reporting to its investors. As of June 30, 2023, CABEI has issued an aggregate amount of US$4.22 billion in sustainable bonds, of which US$1.056 billion have been green and blue, and US$3.164 billion have been social.

To carry out the bond issuance, CABEI has the following programs:

- Medium-Term Note Program:

CABEI's main instrument for bond issuance is its Medium Term Note Program (MTN), registered in Luxembourg for up to US$10,000.0 million. The MTN Program is a flexible mechanism for issuing securities in the international capital markets under different markets, currencies, and maturities.

- Australian Dollar Medium Term Note Program

CABEI registered an issuance program in Australia's local market (Kangaroo) for up to AUD600 million. In 2023, CABEI made its third issuance in this market, first under the blue format.

- Japan Shelf Program (ASR)

This Program is registered in Japan for issuance in the Samurai Market in an amount of up to JPY25,000.0 million.

- Other Domestic Programs

CABEI has also placed instruments in domestic markets through a local registry. Historically, the region's public and private securities markets have experienced the placement of twenty (20) issues, equivalent to US$633.7 million.

Bilateral Financing

CABEI obtains loans and lines of credit from official, multilateral, and bilateral financial institutions and Export Credit Agencies to channel resources to strategic sectors. Accordingly, CABEI seeks to maximize the use of resources from these sources to finance eligible projects and programs within the framework of the initiatives promoted by them, which place particular emphasis on social development, gender equity, and the fight against the adverse effects of climate change.

In this context, CABEI mobilizes and blend resources from International Strategic Partners to provide co-financing and on-lending to create conditions that amplify the inflow of targeted high-impact financial resources to borrowing countries.