Program’s General Objective

Improve financial and operational efficiency of the region’s financial system through the provision of resources to cover its working capital needs and investments in physical, technological and operational infrastructure; in this way, the program will expand and deepen the financial services necessary to promote the economic and social development of the CABEI member countries.

Destination of resources and eligible areas

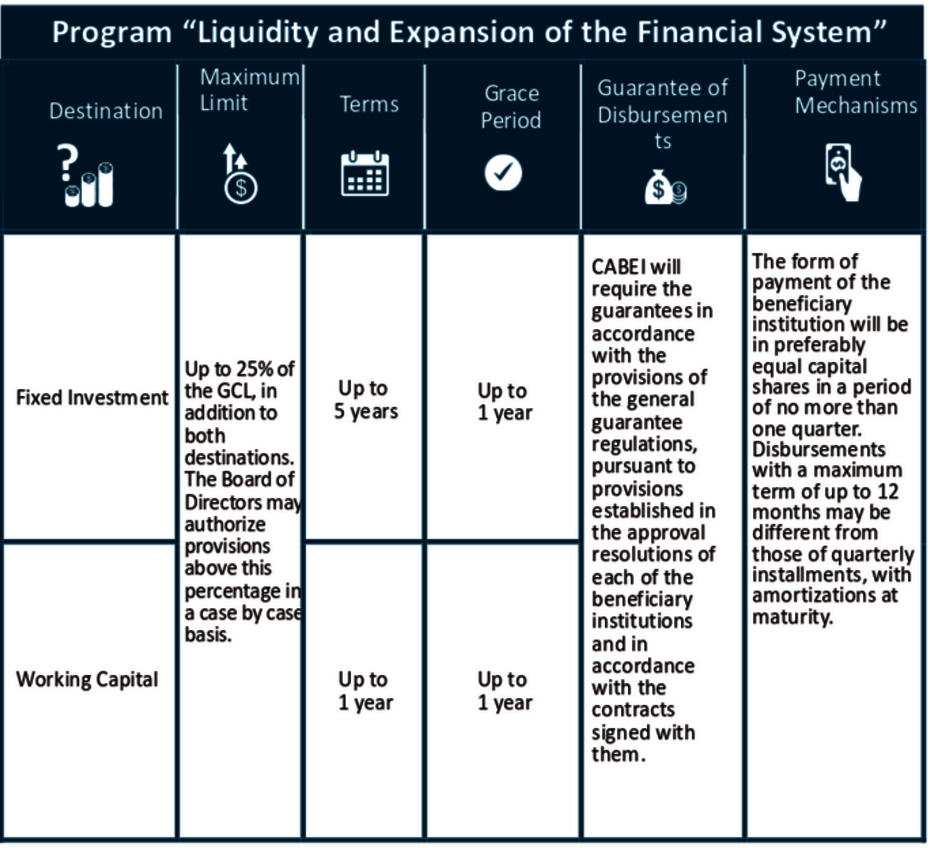

Working Capital.

- Eligible areas: Legal reserve, debt repayment, short-term investment requirements, liquidity needs and expansion of scheduled debt maturity, among others.

- Ineligible areas: Generation of portfolio, payment of salaries, allowances, compensation for dismissals or any other amount for the reimbursement or remuneration of employees of the financial institution.

Fixed Investment.

- Eligible areas: Investment in main office, investment in agencies, equipment, vehicle fleet, intangible assets, hardware, software, ATMs and POS, among others.

Program Liquidity and Expansion of the Financial System PROSIFI321 KB

Improve financial and operational efficiency of the region’s financial system through the provision of resources to cover its working capital needs and investments in physical, technological and operational infrastructure; in this way, the program will expand and deepen the financial services necessary to promote the economic and social development of the CABEI member countries.

| - Be part of Central America’s largest and most renowned intermediary base, which channels resources to different areas of development. | - Pursuant to your growth and performance, request future extensions to your GCL amount. |

| - Use the resources of the approved GCL, in dollars or local currency, pursuant to your financing needs. | - Preferentially opt to technical assistance resources for expansion and strengthening. |

| - Choose different CABEI programs and products, which have been established with the Bank’s own resources and resources from international cooperation organizations. | - Benefit from the different products and services developed by CABEI to strengthen the financial sector, which attends different areas of the region. |