Resource Source

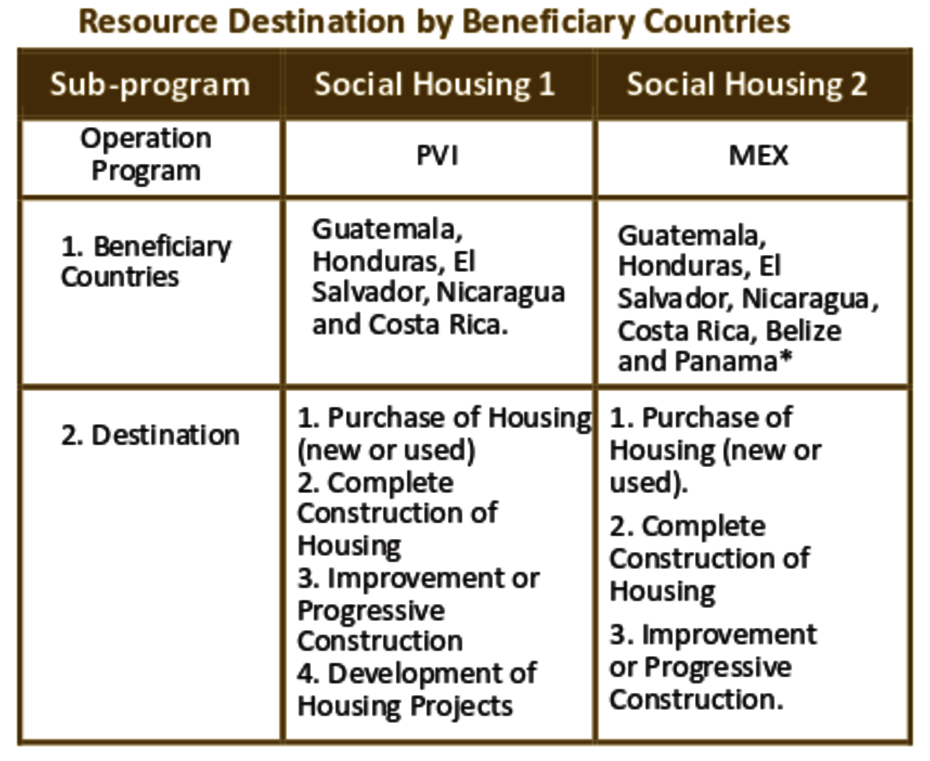

- The Program has two Sub-programs according to the origin of the resources: 1. Social Housing Sub-program with Own Resources (Sub-program 1).

- This Sub-program channels CABEI’s own resources. 2. Social Housing Sub-program with Resources from the Government of Mexico (Sub-program 2).

- This Sub-program channels resources from the Central American Social Housing Development Program, which is sponsored by the Government of Mexico.

[Translate to English:] Programa de Intermediación Financiera para Vivienda Social316 KB

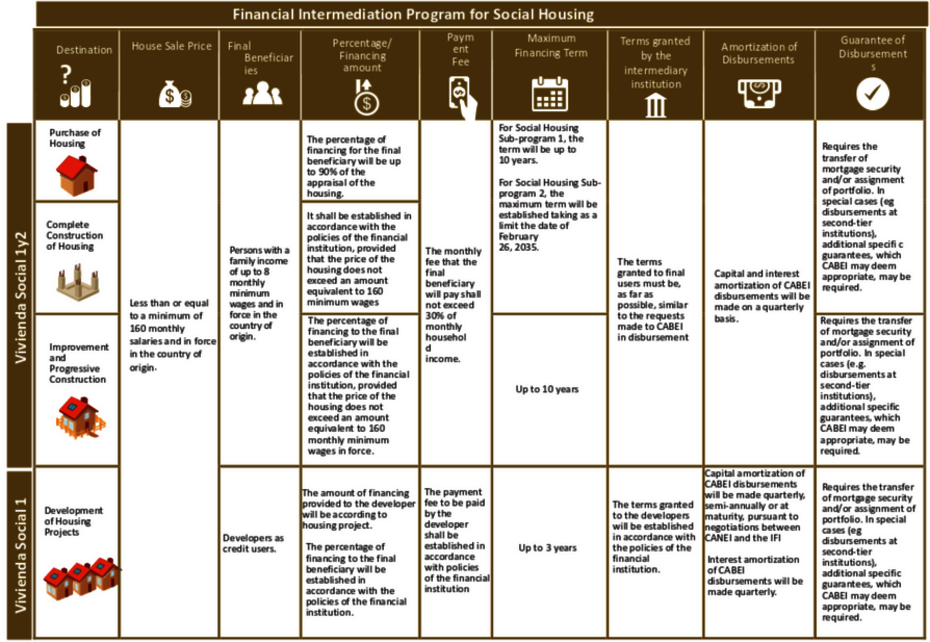

[Translate to English:] Este programa tiene como objetivo ayudar a los hogares de bajos ingresos a adquirir, construir y mejorar su vivienda.

| - Be part of Central America’s largest and most renowned intermediary base, which channels resources to different areas of development. | - Pursuant to your growth and performance, request future extensions to your GCL amount. |

| - Use the resources of the approved GCL, in dollars or local currency, pursuant to your financing needs. | - Preferentially opt to technical assistance resources for expansion and strengthening. |

| - Choose different CABEI programs and products, which have been established with the Bank’s own resources and resources from international cooperation organizations. | - Benefit from the different products and services developed by CABEI to strengthen the financial sector, which attends different areas of the region. |

![[Translate to English:] Programa de Intermediación Financiera para Vivienda Social](/fileadmin/_processed_/9/5/csm_VS_e03d0b8b85.png)