Requirements for Educational Institutions

All educational centers that provide technical education services and university education services or masters and graduate programs may be indirect beneficiaries.

- Submit application letter.

- Provide general historical information.

- Deliver legal documentation: authenticated copy of incorporation, status.

- Include financial statements of the last fiscal closing (Preferably audited).

- Complete official forms concerning the prevention of money laundering.

- Present justification for the application.

- Describe capacities: career description, cost, marketing strategy, market position, skills, teaching capacity, installations, laboratory and special agreements, among others.

- Include stratified characteristics of the student population.

- Provide background of scholarship and educational credit programs: general description and characteristics.

- Describe ex-student statistics: market placement, average income, dropouts.

- Proposals for financing under the PBCE.

- Any other information deemed relevant to the request.

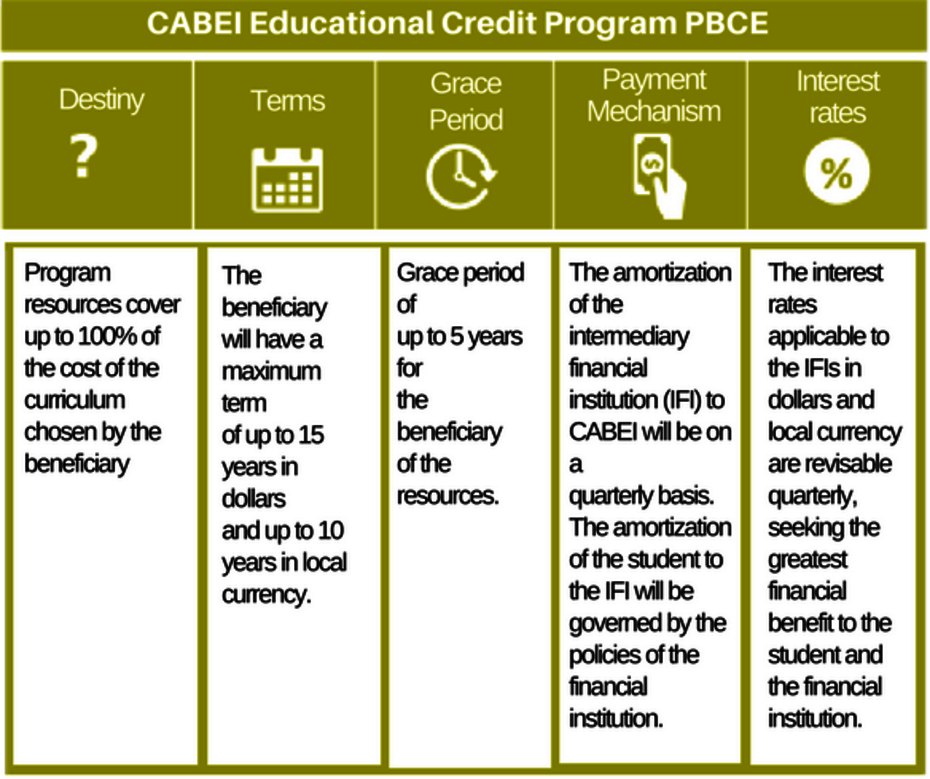

CABEI Educational Credit Program PBCE1,002 KB

Finance technical training and higher education (undergraduate and graduate courses) in order to increase education rates in the region and improve the quality of life.

| - Be part of Central America’s largest and most renowned intermediary base, which channels resources to different areas of development. | - Pursuant to your growth and performance, request future extensions to your GCL amount. |

| - Use the resources of the approved GCL, in dollars or local currency, pursuant to your financing needs. | - Preferentially opt to technical assistance resources for expansion and strengthening. |

| - Choose different CABEI programs and products, which have been established with the Bank’s own resources and resources from international cooperation organizations. | - Benefit from the different products and services developed by CABEI to strengthen the financial sector, which attends different areas of the region. |